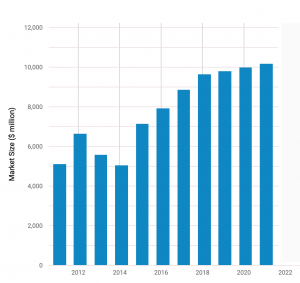

Over the years, medical financing continues to be one of the services that have experienced incremental growth among practitioners in the United States.

According to stats shared by Ibis World, the market size for medical financing has grown at a rate of 1.8% as of 2021 with calculated revenue of $10.2B.

Credits: Ibis World

That said, with healthcare clinics opting for this financial solution for their patients, it can be difficult to figure out which medical financing option will help to position you among your competitors in the best possible way.

In this post, we will break down the top financing options for medical clinics as well as the benefits and drawbacks that they may present to you. That way, you can determine whether they are the right fit for your business needs.

Let’s dive right in.

The Importance of a Medical Financing Business Strategy

Before breaking down the types of medical financing options ought there for clinics interested in offering these services to their patients, it's important to center your choices around a solid strategy.

Your strategy should provide you with a vision as to the kind of results you wish to expect from the finance solutions that you offer.

In doing so, not only will you be able to better align the financing options you provide to your overarching business objectives, but it will also make it easier to determine metrics and key performance indicators (KPIs) that provide you with clear insight into the success rate of your chosen financial service.

Let's take a closer look at some of the main elements that make up a medical financing business strategy.

Patient Acquisition Goals

Before you decide on the medical financing option you wish to offer to patients, it's important that you have a clear idea of the number of patients you wish to attain during a given period.

Naturally, this can be a difficult task on its own. However, the way to get around it is to set realistic medical financing goals for your business. The acquisition goal you develop is usually formulated in a sentence such as:

"I want to acquire at least X number of patients over the next six months."

Once you have an idea of how many new customers you are targeting in a given period of time, think about what type of medical financing options will best suit their needs and make them more likely to purchase from your company.

This is because medical financing options in and of themselves are a way to make your clinic a more attractive service provider and thus pull in more customers.

Key Performance Indicators

Once you have the acquisition goal laid out, then clear and precise KPIs help to gauge performance.

Every medical finance service provider should know exactly what they're looking for when selecting which metrics matter most to their success rate.

Key Performance Indicators (KPIs) are specific pieces of data that help measure performance and establish goals. In the case of medical financing options, you might keep track of how many visits each customer has made or how much income they have generated until they stop using your service, a concept known as customer lifetime value (CLV).

Customer Retention

Customer retention is the measurement of a medical firm's ability to keep customers from switching providers.

This metric is usually reached through a variety of channels such as customer surveys, feedback loops, and support services. If you don't have any information on how many people are leaving your company or why they're doing so, it can be difficult to figure out what actions should be taken in order to increase retention rates.

However, medical financing services constitute an element of a solid strategy for retention as it affords customers an attractive solution to continue using your services.

Knowing this is important since customer retention is usually the cornerstone of a clinic's strategy for longevity since it is more costly to acquire a new customer than it is to retain an existing one.

Customer Satisfaction

The natural complement to customer retention is customer satisfaction. This entails providing a medical experience that meets the customer's needs and expectations in every way.

This includes excellent customer service, cleanliness, quality of care, high-tech medical equipment as well as billing practices with an eye on clarity and transparency.

A satisfied patient will be much more likely to continue using your services which is good news for everyone involved.

Therefore, the medical financing plan you offer must be packaged in such a way that it satisfies the pain points or challenges that your patients typically face when seeking this type of solution.

This is why it is important for medical firms to have a solid understanding of the needs that their patients are trying to satisfy.

That way, you will be better able to select a financing option that best matches their needs.

Medical Financing Options

Usually, medical firms can choose between one of two main options for patient medical financing: an internal financing program administered and managed directly by your company or one that is managed externally by a third-party financial lending institution.

Let's take a look at each one.

Internal Medical Financing Programs

An internal medical financing program is run by medical firms themselves, typically with a dedicated finance staff or medical billing department.

In doing so, the medical firm assumes full responsibility for managing and administrating all financial transactions that are involved in the program.

To offer this program, the medical service provider needs to draft up and approve a medical financing policy on their own which lays out all the terms and conditions to which both the firm and its patients will be subject once they enter into a formal financing agreement. This policy will need to be regularly updated to reflect any changes or modifications that may be brought into effect.

Challenges of Internal Medical Financing Programs

These programs are common because they provide the medical firm with full control over what type of financing options and rates to offer patients. Therefore, since there is less personnel involved in the decision-making process, it is easier to determine and amend financial policies.

However, there are several downsides to these types of programs.

Here's a breakdown of each one:

- Time-consuming & resource-dependent: This process takes time and resources for companies to build out these internal medical financing systems in-house, without any help from outside sources. This means additional staffing costs and overhead expenses can add up quickly as well if you do not manage it appropriately.

- Cost of medical financing: This is a disadvantage when it comes to determining how much money they are making on each procedure. If this program makes them more or less than what their current reimbursement system does, then there’s an issue that needs to be addressed immediately before things get out of hand and turn into debt for your company.

- Lack of flexibility with rates: It can be difficult to provide flexible medical financing options since these programs require hard numbers in order to function properly. That means you're stuck at whatever rate was set upfront without any room for negotiation or change, which may not always satisfy patients (or make sense financially).

- Marketing costs will skyrocket: One of the disadvantages of internal flexible finance programs is that marketing costs tend to be elevated because the firm assumes advertising costs for medical financing to your patients. While that may not be an issue for some companies, it can easily add up if the program doesn't yield enough customers and income to make a profit.

- Logistics are difficult: The logistics of running an internal medical finance program is also complicated because there's no one-size-fits-all solution as each firm will have its own set of rules and regulations on how this type of service should run. Plus, there's always the risk that someone within your company could exploit loopholes in these programs.

Third-Party Finance Plans

In light of the several challenges experienced by firms that offer medical financing options, the second and more preferred option is third-party finance plans.

Third-party finance plans are medical financing option that's managed by a third party, such as medical insurance providers or medical finance companies.

There are several benefits associated with this type of financial plan:

- High efficiency: The firm will have more time on its hands to focus on other parts of the business instead of having to worry about running an internal medical finance program.

- Customer-centric solution: You can dedicate yourself to customer service since it becomes easier for you to offer your clients different options in terms of how they pay for their treatments with this type of plan.

- Cost-Effective - It also provides some cost efficiencies because all payments are collected through one source (the third party).

The best type of finance plan that medical firms can offer for patients with a third-party finance company is flexible finance plans.

Understanding Flexible Finance Plans

A flexible finance plan is a type of medical finance option that patients can utilize for themselves or their family members and to cover the cost of medical treatments based on terms and conditions.

There are several benefits to offering flexible finance plans as a medical finance solution for your patients. These include:

- Possibility for increased income streams: Medical financing plans may allow medical providers to offer medical care for patients with poor credit or no credit, thereby increasing the number of clients they can serve. This is especially important because many patients cannot access medical treatment due to a financial or credit handicap.

- Ideal for customer acquisition and to generate interest: Flexible medical financing can be used to enable your patients to pay off medical bills over time. When a patient has medical expenses, this type of medical finance plan gives the opportunity for the patient to buy their way out of debt and into healthcare. All in all, it has a positive impact on sparking interest within customers to utilize your services.

- Variety in terms: These plans are flexible so they can accommodate different needs and budgets, both for your firm as well as for your customers. Therefore, you stand a better chance at delivering a wider range of solutions that match the different pain points that one or more segments of your patient market may experience.

Choosing A Medical Financing Lender

While flexible finance plans are a solid choice to help offer medical financing to your patients, they are only as good as the lender with whom you partner.

Some medical financing lenders are better than others. If you don't take the time to do your research to know which medical financing lender is right for you and your patients, then this can be a waste of time and money.

Here's how you can align with a legitimate and professional third-party finance lender to deliver the kinds of solutions your patients are looking for.

Flexible Finance Plans With Time Investment Company

Time Investment Company is a financial institution with a trajectory of more than forty (40) years assisting businesses across the United States to secure the financial solutions the best suit their needs.

For years, we have partnered with companies in the medical and healthcare industry as third-party lenders to deliver attractive and functional flexible finance plans for patients looking to finance a medical operation or service.

Our flexible finance plans are customer-centered solutions custom-designed to make financing your services easier, more accessible, and more desirable so that you can increase your service orders and pull in more revenue.

As a family-led financial institution grounded in core values that emphasize fair treatment and optimal service, we understand how important it is for medical firms to secure the full capital owed to them on their services as soon as possible.

With Time Investment Company, as soon as your patient is granted financing approval, we release the full amount owed to you immediately while we assume the task of handling the repayment schedule with your patient.

It's a win-win since you get to offer a solution your customers love with little-to-no risk in return.

Partner With Time Investment Company for Medical Financing Today

Medical financing is a lucrative yet complex initiative that can only be successful if you align with the right third-party lender.

Time Investment Company can help you deliver just that with our flexible finance plans.

Schedule a strategy call with us today to charter the path for a win-win financial solution today.