How to Increase Buying Power of Your Customers

Posted on March 30, 2022

You can have the greatest product in the world. But if your customers can’t afford to pay you for it, you’re stuck.

Yes, people need to do home repairs and home improvement projects. These typically cost thousands and sometimes tens of thousands of dollars.

At the same time, the average consumer would have trouble writing a $1,000 check without having to borrow money. According to a recent survey from Bankrate.com, only four in ten Americans could cover a $1,000 emergency.

Contractors, water purification system distributors, medical professionals, mechanics, and anyone else who sells higher-ticket items have two choices:

- Walk away from the majority of potential customers, or

- Find a way to close the affordability gap.

The simplest thing to do is to discount. Offer a lower price. But that only goes so far. Especially when you're selling a $5,000 project. Maybe you can discount it down to $4,500, sometimes. But even that, still only helps a few people. You’ve still excluded a vast spectrum of your potential customer base.

Unless you have a specific reason, or you’re getting something of value in return, discounting at the outset is usually a bad idea.

There’s a better way: Expand your customers’ buying power, so that your customer with just $800 in ready cash can quickly and easily afford your $5,000, $15,000, or even $50,000 ticket size.

They may not have much savings. But they may have plenty of income - or a way to raise the money in the future - and that’s enough for you to do business.

There are multiple ways to make it easier for customers to purchase your product or service. Here are several proven techniques:

1. Layaway

Retailers have found that layaway programs are effective at turning walkaways into sales and building customer loyalty - without having to discount.

Tell the customer you can reserve the item at today’s price if they just put down 10 or 20 percent, and bring in the rest within 90 days.

That’s much better than discounting. You get a chunk of your eventual profit upfront. And occasionally, a customer doesn’t come back, essentially forfeiting their deposit. Of course, you’d rather sell it to the original happy customer.

Tip: If operating margins are narrow and operating cash is a concern, set your minimum deposit equal to your expected profit margin. That way, your layaway program over time will still generate enough revenue to sustain you while you wait for your layaway customers to come back to pick up their items.

If they do, great! If they don’t, you wind up keeping their deposit and selling the item anyway, giving you ‘two bites at the apple,’ as it were.

2. Offer ‘90-Days-Same-as-Cash’

The 90-days-same-as-cash offer - sometimes called interest-free financing is another proven sales generator. Lots of people have a short-term cash crunch that makes it impossible to buy immediately but are very comfortable about their ability to pay for it at some point within the next three months.

Some businesses will ‘tote-the-note’ themselves, relying on the customer’s word - especially on smaller items.

Credit cards will also provide the customer up to 4 to 6 weeks of interest-free financing, as long as they pay the balance before the due date. And dozens of “buy now pay later (BNPL) companies are entering the market, using artificial intelligence technology to underwrite their loans and help customers spread payments over several weeks or months.

Most contractors don’t want to finance large tickets themselves. They don’t want to be out the cash flow that long, and they don’t want to have to administer a collections department. So they partner with a finance company that will take over that function for them.

The 90-day term isn’t set in stone. You’re free to work with your finance partner to design an interest-free period that makes sense for you and your customers.

The customer doesn’t pay any interest if they make their payments on time during that period. Instead, the seller receives a discounted payment from the finance company.

Example: You offer 90-day interest-free financing to the customer for a $5,000 project. You receive payment of, say, $4,750. The customer pays the finance company back the full amount over the next 90 days.

The longer the term, the deeper the discounted payment will be to you, the seller. Also, this discount will typically vary with interest rates. When prevailing interest rates rise, you’ll receive a lower payment on the same amount of money. When interest rates fall, you’ll receive a higher payment for the same loan and terms.

3. Deposit-Plus-Milestones

Many contractors don’t get the full amount upfront. Instead, they’ll just get a deposit sufficient to cover ordering materials, pulling permits, getting insurance or buying a completion bond, and labor costs for the first week or two of work.

That way, the contractor has cash in hand to get the project started. The customer can enter the contract now, without having to have the full amount on hand.

The customer pays the contractor when certain agreed-upon milestones are reached, with the final payment on completion of the project.

A good contract manager can design a contract and series of payments so that the contracting firm is not actually out significant cash flow at any given time. Each payment is sufficient to cover all the contractors’ out-of-pocket expenses for the stage of work.

This system works well for more complex projects with reliable counterparties. It also avoids financing expenses for you and your customer.

However, the contractor does take on some risk: The risk that the customer will elect not to complete the project.

By using a third-party lender to finance the transaction, you as the contractor can get paid upfront. If the customer wants to back out of the contract, you aren’t at risk.

4. Use Consumer Financing

Credit cards can be convenient. But they typically have high interest and very low limits for most people. Your customers may be able to get a loan from a bank or credit union. But these traditional lenders typically have strict credit requirements, will demand collateral (e.g., a home equity loan), or both.

Using a non-bank lender consumer finance company is a proven way for contractors to turn prospects into customers - without giving up control to banks, who are notorious for turning down all but stronger credit types, and who may not have financing solutions tailored for your particular industry.

That way, you can close the affordability gap, create a happy customer who can now enjoy the benefits of your products and services.

Meanwhile, you get paid the full price of the project upfront - instantly. The Time Investment Company releases funds immediately when an approved customer confirms the sale. So you never have to wait on a check in the mail.

What’s more, when you make financing available and bring it up early in the sales interview, many times you are discussing a bigger ticket size right from the beginning.

When you bridge the affordability gap, lots of things become possible that weren’t possible before.

It’s a good idea to have multiple ways to help increase your customers’ buying power. But in most instances, for people with less-than-perfect credit and who aren’t well-served by traditional lenders, partnering with a consumer financing company that specializes in their industry is the most efficient and the most powerful.

Improve your customers’ buying power today! Partner with the Time Investment Company to provide easy, affordable financing that helps you close sales and grow your business.

You have the customers. We have money to lend, and we’re looking to lend more. Simply fill out our brief vendor information form, and we’ll contact you shortly to see if we should be working together.

Benefits of Consumer Financing for Merchants

Posted on March 28, 2022

Contractors and allied vendors benefit strongly from offering consumers and other customers a financing option.

Consider:

According to Bankrate, only 4 out of every 10 Americans can afford to spend $1,000 at once. That's roughly 39%.

With anything past that price point, you have already cut yourself off from serving more than half your potential market. Even with the best salespeople offering the best solutions that obviously benefit the customer, you can’t get blood out of a stone: If the customer can’t afford it, you’re dead in the water.

Customer Financing for Merchants

But if you can answer the price objection with an easy and affordable customer financing program, you are right back in it, and chances are excellent you will have a new customer.

Now, here’s another statistic: 76% of customers are more likely to make a big ticket purchase if you offer a seamless and convenient payment plan.

See, they can afford your products and services – just not in cash. Offering a consumer financing solution allows your customers to ‘cash flow’ their way into being able to make the purchase.

Consumer financing helps you help your customers increase their purchasing power. That’s’ a win-win solution for everybody.

Customer Financing Increases Average Ticket Size

When you offer financing to customers, you’re likely to increase your ticket size, or average order value (AOV).

The order value is the total value of an order placed by a customer, including all of the products and any add-ons.

In addition to opting for add-ons, when customers have the option to finance their transactions, they may also choose to purchase the more expensive/advanced versions of said products.

Consumer Financing Increases Sales

Research shows that closing ratios run between 5% and 20% for new customers. But for existing or returning customers, closing ratios increase to 60% to 70%.

When you offer customer financing, you can convert more of those new prospects to existing clients – and help those existing clients afford bigger transactions. They know your worth. They know what to expect from you. And they know you can help them afford it.

As a business owner, offering equal monthly payments or other financing options and financing solutions to your customers can boost customer satisfaction, loyalty, and boost your cash flow.

Once the customer signs the financing agreement and confirms the sale, you receive full payment on financed transactions upfront. Your customers pay monthly payments that they can afford.

Differentiate Yourself From the Competition

Consumer financing is a proven effective differentiator in advertising. We’ve all seen car companies and dealers lead with customer financing programs:

- “Zero interst financing!”

- “Low down payment!”

- “90 Days Same as Cash!”

- “Everybody Gets Approved”

- "Four equal monthly payments!"

If it weren’t effective, they wouldn’t do it.

Offering consumer financing can help differentiate you from the competition, build customer loyalty, and help you stand out.

If you have a great financing provider in your corner, it makes sense to shout it from the rooftops.

Don't Rely on Bank or Credit Card Financing

The problem with traditional financing companies - banks, credit unions, and credit cards, is that they frequently won't approve customers with a less-than-pristine credit history. Or in the home improvement industry, they may want to hold the customers' homes as collateral.

Credit cards often don't have a high enough credit limit to be realistic customer financing options.

Instead, when you offer customers a payment plan through a good third-party financing company, you can offer realistic and affordable payment plans to customers with a more challenged credit history, and with a variety of credit scores. By partnering with a third-party provider, you can offer financing in house, level the playing field against your larger competitors, and generate increased sales to

Offering payment options can help small businesses increase sales,

By offloading collections and accounts receivable department to third party providers, and customer financing platforms, you get paid upfront, also reduce your legal responsibilities and legal risks, while significantly improving your business's cash flow - a key component of running a successful business.

Meanwhile, when you provide consumer financing through third-party financing companies may help you reduce or eliminate credit card discount rates and transaction fees, and reduce your exposure to chargebacks.

Tips for Boosting Consumer Financing Awareness

- Let the customer know that they don't need to look for an outside lender. You already have a financing partner.

- Let them know that the application process is straightforward, and they can do it online. (It's always better to go with providers that have the online option.)

- Let them know that the loan amount depends on their credit score, but also let them know that, unlike their credit card company, there’s no limit.

- Have a privacy statement on your Website and on your financing agreements. Make sure your customers know you respect their privacy and will safeguard their consumer credit information.

- Let them know that approval rates are higher than with other types of lenders – especially bank lenders (Inform yourself about additional details with your provider.)

6 Benefits of Offering Home Improvement Consumer Financing

Posted on March 27, 2022

In today’s competitive environment, offering home improvement customers competitive financing options is a must. Studies show that half of the American consumers would have trouble writing a check for $1,000 in an emergency. And most home repair and improvement projects cost much more than that. Even many homeowners are cash-strapped.

By partnering with a consumer finance company that specializes in the home improvement industry, your business may realize some important benefits:

1. Close More Deals

Having financing services available gives home improvement customers the flexibility to choose the payment option that fits their budget. You can show potential customers that they can get all the materials they need by breaking down expensive purchases into affordable monthly payments.

This way, you immediately eliminate the biggest buying constraint and increase their purchasing power.

A recent study found that home improvement companies that started offering a financing program to customers were able to increase sales by an average of 32%. So, if one of your KPIs is to close more deals, you should consider implementing a contractor financing program.

2. Increase Your Average Deal Size

By showing how a slight increase in your home improvement customers’ monthly payments can help them get their desired upgrades, you can up-sell your customers. When it comes to home improvement projects, a relatively small upgrade can be what makes the project cross the line between a regular home renovation and a dream home renovation for a customer.

Making it possible for them to get that extra piece of furniture, paint that additional room, or add a pool to their outdoor space not only improves their experience as a customer but also makes an enormous difference for your company in terms of revenue in the long-term.

Your affordable financing program can be a key piece of your sales when it comes to increasing transaction sizes and driving up your business’s average order value. A survey found that organizations’ average transaction size increased by 15% when they started offering home improvement financing to customers.

3. Reduce Financial Risk

When you choose to have a third-party financing company managing your customers’ transactions, you avoid all the damage associated with direct consumer lending.

If not carefully managed, consumer financing can cause serious damage to a contractor’s cash flow. Since the specialized third-party lender is responsible for everything after the checkout, you delegate this risk.

They will determine the interest rates based on credit score, collect monthly payments, and secure late and missed payments.

This means that you can offer customers low monthly payments without having to assume any financial risks.

4. Build Customer Loyalty

Allowing customers to purchase with flexible financing options will provide customers with an excellent experience with your company. 93% of customers who use consumer financing to make a purchase would choose to use it again for future purchases.

This means that offering financing services through a specialized third-party company will help you create a long-term relationship with clients. Aside from the obvious advantages this service offers to clients, the interest rates are typically lower than those offered by credit card companies.

Once customers know about your financing options and understand how they can benefit from them, they will be more prone to think about your brand when they need your service again -- or even to recommend your company to friends and family.

5. Attract New Customers

In the same way that you will retain customers, you will start seeing more new faces entering your business’ door. Your financing programs will allow you to grow your potential customer base by making your products and services affordable to a larger number of people.

If customers can choose between buying a product in your store, where they can count on flexible financing alternatives, or buying that similar product in a store with a strict payment process, they will choose your store.

Breaking down large purchases into manageable payments is a simple way to enlarge your pool of potential customers. It’s as simple as that.

6. Access Your Money Faster

Partnering with a third-party financing company allows you to access the money pertaining to your services and products as soon as you sell them.

In almost every case, your company is paid the full purchase amount once the customer signs off on the work. So, your business is not affected by cash flow issues that can arise with in-house lending programs.

This means that your company won’t be held accountable if a customer misses a payment or fails to pay the loan amount. The financing company is the one assuming the risks. This benefit alone can pay off in a short period of time.

The benefits of offering a consumer financing option for home improvement, construction, rehabilitation, plumbing, roofing, water filtration, and similar customers are overwhelming. Those contractors still relying on bank and credit union financing and credit card financing are increasingly being left behind.

To partner with a finance company that understands your business and can help you offer your customers a convenient and affordable financing solution, fill out our vendor application.

Best Home Improvement Business Software to Leverage

Posted on March 26, 2022

Just a few years ago, it was common for contractors to run their businesses with a mobile phone, spiral notebooks, manila folders, and a bookkeeper to keep track of it all.

Those days are over.

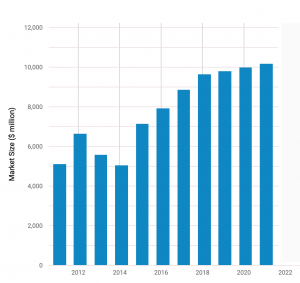

Advancements in information technology are revolutionizing the way home improvement and construction industry firms are doing business. Today’s technology is allowing contracting firms of all sizes to increase their efficiency, reduce error rates, and improve profitability. Investing in the right construction management software allows businesses to become more competitive and serve their customers better. Businesses relying on outdated technology - or no technology at all - are increasingly being left behind.

Today’s contractors are integrating many different categories of home improvement business software into their operations; Here are some of the most common in use today in the construction industry:

- Remodeling Estimating Software

- Customer Relationship Management (CRM) Software

- Interior Design Software

- Landscaping Design Software

Some of these programs are free, others require you to pay for the full version, generally under the SaaS (software as a subscription) model. Naturally, the paid versions tend to offer broader and deeper functionality. Some of them are stand-alone packages, while others have bid management and accounting features and are designed to integrate with broader business management programs. Most are cloud-based and accessible on your mobile device. So you can use them on the road or on the job site.

This article will discuss some of the best and most popular estimating and construction management software programs for general contractors or residential remodelers under each of these categories.

Construction Industry Remodeling Estimating Software

Remodeling estimating software helps home improvement contractors quickly assess the essential material and labor costs required for renovation and remodeling projects. These programs automate common calculations of the following elements:

- Materials

- Time estimates and labor

- Square footage

- Project scheduling, and more.

These construction management software products allow construction professionals and residential builders to quickly and easily create estimates and manage customers. The more sophisticated remodeling estimator programs are integrated with local suppliers, who regularly update pricing on the software platform, so you can get an accurate materials estimate without having to constantly contact suppliers and manually input that information into the program – or worse, yet, into a spreadsheet!

Note that this function also allows users to compare the cost of materials from different suppliers.

Why Use Estimator, Project Management, And Construction Management Software?

Today’s crop of home estimator and construction software packages allows home improvement contractors to make more accurate bids than the traditional method of drawing estimates on paper or using a spreadsheet. Plus, it helps homeowners to make their renovation estimates and perform an accuracy check of bids on residential projects.

Examples of these remodeling estimating software include:

B2W Estimate Software

B2W Estimate Software is a heavy construction estimating software platform It was built with the latest SQL Server and .NET technologies. With B2Wm home improvement contractors can carry out their cost evaluations quickly and more accurately. In addition, the software is easy to use, whether as a new or an existing software user.

B2W also creates a single database to track and manage costs, tasks, pay items, crews, and resources. This helps the estimators to manage their data easily and efficiently in one place, on all kinds of construction projects

Construction management software also enables contractors to make construction bids with speed and accuracy.

One interesting feature: Furthermore, multiple contractors can collaborate, working on a bid at the same time. This is beneficial to larger businesses that need to integrate information from multiple disciplines or departments in one bid, or where contractors and subcontractors need to provide input into the proposal and get it out the door before the bid window closes or some other firm lands the business.

ProEst

ProEst is another cloud-based construction estimating software with tons of advanced features and functionalities. Its features include - digital takeoffs, customized reporting, customer relationship management, estimating, and bid day analysis.

Other highlighted features include:

- Easy and fast cost estimating

- Professional-looking, automatically-drafted construction proposals and reports

- On-screen digital takeoffs, which makes labor, material, and tools cost analysis easier.

- Built-in CRM

- Subcontractor invitation-to-bid functionality

- Document management

- Integration with accounting

- Mobile capabilities

Viewpoint ProContractor

Viewpoint ProContractor is a cloud-based software suitable for use as a desktop or mobile application. It is one of the best remodeling estimating software that allows its users to compute the labor costs, purchasing materials, and equipment. Also, it helps to generate payrolls and invoices.

Viewpoint is an excellent software to handle construction jobs. For your estimations, project, business, data, financial and operations management, Viewpoint ProContractor is a perfect fit for your job.

ViewPoint has several packages that are optimized for certain types of contractors. For example, they have a specific program for HVAC and sheet metal contractors, plumbing and piping contractors, and specialty contractors.

Clear Estimates

Clear Estimates is a cloud- and web-based estimating software. Because it is less expensive ($59 per month) the full version is suitable even for small contractors and professional remodelers.

It’s affordable, easy-to-use, and comes with detailed templates for common home improvement projects, such as kitchen remodels, room and basement remodeling, and handyman services, to help even small contractors develop accurate bids without spending an inordinate amount of time on them.

They also include functionality for specialty trades, such as HVAC, electrical, roofing, painting, and plumbing.

The software is linked to a RemodelMax database that provides regional price information from major suppliers, updated every three months, making it easy for the contractor to make an accurate estimate.

Sage Contractor

Another widely used, cloud-based construction estimating program is Sage. This company makes a number of separate but integratable software packages spanning construction, estimation, project management, payroll, HR management, and more.

The Contractor suite It is a flexible software platform that allows contractors to make better estimates and manage their projects, documents, and services.

Some of the key features you can enjoy using this software include -

- Digital takeoffs

- Project management

- Job costing

- Contract calculation

- Several unique cost databases

Sage Estimating features superior takeoff tools that make it possible to transfer 2D and 3D takeoff information into the solution quickly and efficiently. Integration with Sage 100 Contractor and Sage 300 Construction and Real Estate allows users to export budgets, purchase orders and subcontracts without the need for duplicate data entry.

Pre-populated RSMeans cost databases offer everything from site work items to electrical components, and City Cost indexes.

UDA Technologies' ConstructionOnline Software

UDA Technologies’ ConstructionOnline construction management software was designed for homebuilders, remodelers, and real estate developers. It is a web-based platform that can also be used to manage projects and customers and schedule jobs.

Thousands of buyers rely on UDA’s ConstructionOnline platform to find construction suppliers to complete their projects. ConstructionOnline provides a range of high-quality suppliers for buyers to choose from.

Other essential features include:

- Gantt chart styles scheduling, which allows users to convert tasks to groups easily.

- Photo management

- Cost management

- Project management

- Contract management

- Home configuration

- Password-protected online portal for clients

- Orders processing

Customer Relationship Management (CRM) Software

Customer relationship software helps contractors to provide customer satisfaction. The best CRM software platforms help you access and manage customer data, handle your customers' tasks, and effectively manage your business.

Some CRM programs are stand-alone programs. Others are designed to integrate with other functional areas, such as accounting, scheduling, project management, invitation-to-bid, and more.

The overall trend has been for CRM programs to become more industry-specific and integrate a broader array of functions. So even if you’re currently using a legacy CRM platform, it might be worthwhile to explore more contractor-specific software options such as the ones listed below:

Builder Prime

Builder Prime software is specially designed for contractors and home improvement professionals. It’s a combined CRM, estimating, and production management application that offers tons of useful features and functions for contractors.

In addition to contact management, it also integrates a flexible scheduler where you can add your appointments, to-do tasks, job descriptions, and delegated tasking for all your employees.

Additionally, Builder Prime also helps you automatically generate a detailed, professional-looking proposal. The program also quickly generates custom client invoices and helps you track the payments.

Buildertrend

Buildertrend was designed to make construction businesses more accessible and better. Cloud-based software designed for remodelers, specialty contractors, commercial contractors, and home builders.

The Buildertrend solution is loaded with useful features such as:

- Pre-sale tools

- Automated Customizable proposals

- Cost estimating tools

- Digital signature functionality

- Client relationship management

- Lead capture from website traffic

- Email marketing tools, including automated blasts

- Project management tools

Further, the Buildertrend solution includes these additional project management tools help you get your jobs completed on schedule:

- Client reminders

- Job scheduling

- Real-time reporting

- File sharing and organization

- Intuitive, easy-to-use team collaboration functionality

- Tasks creation and delegation/assignments and task tracking

- Real-time work-in-progress reports

- Easy documentation and information sharing with the team, subcontractors, and clients.

- Bidding

- Invoicing

- Time management

- Orders processing and management

- Tracking costs, billings, and orders

- Online payments and payment remainders.

JobProgress

JobProgress is another popular and compelling home improvement software option for contractors. You can make your job less demanding by using JobProgress to manage your business. This platform helps contractors ensure job progress is made on multiple projects, satisfy more clients, and be more productive with less effort.

Key features include:

- Fully Customized Job & Workflow Manager

- Paperless Mobile App

- Customer Relationship Manager

- Online Sales & Marketing

- Quick Estimating, Quoting & Scheduling

- Remote Business Control

- Dashboard Workcenters

- Safe Cloud Storage & Access

- Employee And Subcontractor Manager

- Instant Proposals And Contracts

- Office, Field & Operations Manager

MarketSharp

MarketSharp is an excellent CRM software for contractors, workers in the remodeling business, and home improvement contractors. It’s a turnkey, all-in-one software package that integrates lead management, CRM functions, cost estimating, scheduling, productivity, and project management all on a single platform.

MarketSharp also allows you to manage your projects, schedule jobs, estimate costs, and turn your one-time customers into lifetime clients.

Interior Design Software

Interior design software allows you to create a realistic visual layout of a home or building interior, allowing you to quickly and efficiently depict your post-project ‘vision’ to the customer.

Today’s interior design software packages make it a snap to collaborate with customers and subcontractors to communicate options, recommendations, and the desired end state for all kinds of remodeling and interior design and decor projects.

Here are the most common interior design software packages popular with home improvement contractors today

Roomstyler

Roomstyler is a free, easy-to-use, cloud-based design software that allows users to create simple floor plans. It allows users to modify the shape, size, and dimensions of existing room shapes and use a library containing furniture and fixtures that can be added to any floor plan. Users can also add doors and windows and adjust textures using a paintbrush tool.

SketchUp

SketchUp software is widely used by architects, engineers, and interior designers. It is a web-based application that allows users to design and view 3D models on their devices. Users can also convert the 3D designs into 2D models for easy documentation.

The platform offers a free version for basic users, while professionals and those needing more advanced functions can opt for the Sketchup Shop ($119/year), SketchupPro ($299/year), or Sketchup Studio ($699/year).

Even the free version allows for unlimited cloud storage and access to pre-built 3D models.

Design a Room

Design a Room software by Armstrong Flooring is a great free application that allows you to design a room from scratch or redesign an existing one. You can either upload pictures of your existing space or select a design template from the available ones on the site.

You can then edit the room by changing the flooring, paint, and furniture till your desired design is achieved.

It’s a great tool to refer your customers to, because they can experiment and come up with design ideas themselves. And when it comes time to do the work, naturally, you’ll be the first contractor that comes to mind when they’re ready to go.

Landscaping Software

Landscaping software makes it easy to design outdoor spaces such as gardens, parks, pools, corporate and academic campuses, even golf courses. This software helps you visually present how you want the outdoors areas of a home, business, or public space to look. Point and click technology makes it easy to move things about until you reach a solution that will help you achieve your landscaping goals.

Here are some of the best and most popular software solutions specifically designed for landscaping.

LMN

With over 85,000 users, LMN is among the leading software solutions designed specifically for landscaping and outdoor planning contractors. The free version supports budgeting, limited estimating, CRM, and time tracking functions. Most contractors will quickly upgrade to the Pro version, which includes these highly beneficial features:

- Business planning tools

- Estimate builder

- Job and payroll reporting

- Sales and marketing reports

- Time tracking

- Scheduling and dispatching

- Credit card processing

- Customer portals

- File and photo storage

- Gamification

If you’re a landscaping or outdoor services contractor, LMN is a proven choice for the technological backbone of your business.

Garden Planner

The Garden Planner software designed by Small Blue Printer is an easy-to-use landscaping and garden design tool. It can be used on either Windows or Apple OS. Users can select objects such as plants, furniture, etc., from the library and add them to their designs.

iScape

This is a perfect interior design application for iOs devices. The iScape app allows you to design your outdoor living space before you bring them to real life. You can also use it to redesign an existing space.

Whether you are a homeowner or a landscape contractor, you can use iScape to create so many outdoor styles and designs. In addition, the app itself has a library of trees, plants, and fences that users can add and move to their desired location.

Ready to Close More Deals?

Many people want you to remodel or renovate their homes but cannot afford your services. Help your customers and prospects patronize your business today by partnering with Time Investment.

At Time Investment, we offer financing via various payment programs to help our partners' customers who have businesses in multiple industries such as HVAC, Healthcare, Water treatment, etc.

Fill out our inquiry form to learn more about our services.

How to Offer Hearing Aids Financing

Posted on March 25, 2022

Hearing aid financing is one of the most discussed financial options among service providers today.

While it is true that hearing aids are a technological marvel that can change lives, they also come at a cost. At times, they can be so costly that those who are in need are unable to access them. Either that or people delay purchasing them for as long as possible.

Fortunately, there are hearing aid financing options available that service providers like you can offer to your patients.

In this blog post, we will cover the different hearing aid finance options that businesses leverage as well as the way in which you can go about offering the best type of solution for your customers.

Let’s dive in.

An Overview of Hearing Aid Financing

Hearing aid financing is an option granted to patients suffering from hearing-related medical problems to cover the cost of hearing aid under favorable repayment terms and conditions.

The hearing aid chosen by your patients will largely depend on their hearing needs and the severity thereof. There are two factors that determine hearing-aid cost:

- The amount charged by hearing-aid manufacturers for each hearing device;

- The amount negotiated between audiologists (those who provide care) and insurance companies or third-party payers (who bear some responsibility).

For that reason, there are multiple ways in which hearing aid can be financed. For instance, it may consist of a payment plan where the patient has to pay back the cost of the hearing aid based on the applied interest rate. Conversely, it can also be done through 0% financing if the service provider opts to go that route.

Contemporary and innovative finance options arose when clinics saw that a growing number of patients became more hesitant to use traditional sources of credit financing such as credit cards.

Patients are less inclined to use credit cards to finance hearing aids because credit cards usually come with elevated interest rates. Even if hearing aids are purchased through a credit card, there is the added expense of monthly interest payments that can quickly add up.

What's more, some patients are ineligible to access credit options either because they have a bad credit history or do not meet one of the eligibility requirements established by the credit company.

In a nutshell, traditional finance options used by patients have become less attractive. For that reason, clinics themselves are now exploring different ways to finance the hearing aids that their patients wish to purchase.

Benefits of Hearing Aid Financing

Those clinics that offer hearing aid financing tend to enjoy several benefits for overall growth and revenue increase.

Let's examine some of these benefits:

- Tap into larger patient bases: Clinics that offer hearing aid financing tend to reach more clients. This is because financing makes your services more accessible to customers and therefore increases the likelihood that you will acquire more clients over time.

- Increased revenue gains: Those clinics that provide hearing aid finance solutions to patients augment the chance that they will pull in more sales. This is because the more accessible your services are to your customers, the more service orders you will receive, thus leading to more sales.

- More customer referrals: Those patients who need assistance paying for their hearing aids will often refer family members or friends looking into purchasing new hearing devices to your clinic as well. Customer referrals are a free form of marketing that allows you to pull in more patients thanks to the positive experience customers have had with your clinic.

Clearly when it comes down to profitability and growth, offering hearing aid financing is advantageous for any clinic seeking these benefits. Patients appreciate having access to funds on credit terms.

However, in as much as hearing aid financing can help clinics grow, if you don't offer the right type of finance plans, you may end up working against your ultimate goals.

Let us examine some of the finance options that clinics can offer to their patients.

Types of Hearing Aid Financing

In most cases, clinics can choose between one of two ways to offer hearing aids financing to their patients: either by managing it internally directly through your clinic or by doing so externally and partnering with a third-party lender who takes the challenge of managing financing off your hands.

Let's dive into each one.

Internal Hearing Aid Financing Programs

Internally managed hearing aid financing programs are, in essence, a way for clinics to offer the financial solution of hearing aids that their patients need without actually handling any credit-related transactions.

In doing so, a clinic creates its own proprietary hearing aid financing program. The clinic assumes sole responsibility for hearing aid financing and credit-related transactions as well as all other aspects related to the management of the finance program.

In such cases, the clinic needs to meet certain legal requirements. For example, a hearing aids finance policy needs to be drafted and approved by stakeholders and senior management alike in order for this service to be offered.

What's more, they are also required to upkeep and update a list of eligibility requirements and ineligibility charges where necessary for each of the financial programs you are offering. This can be gathered in the form of an official document that can be subsequently circulated among potential clients letting them know more details about the service being offered.

This type of program is heavily reliant on staff and clinic policies.

As a result, clinic employees are expected to have a firm understanding of policies and enforce them where necessary. Failure to do so will result in compliance compromises with clinical regulations which can land you in legal trouble or unnecessary fines and sanctions.

Usually, clinics offer these programs by requesting that the patient pay a percentage of the fee on their service upfront. The clinic then examines the patient's credit score and uses their credit information to put in place a payment plan that the patient must adhere to.

While internal hearing aid finance programs are an option for patients, they are far from perfect.

Let's take a look at the challenges associated with these types of initiatives.

The Danger of Offering Internal Hearing Aids Financing

As a clinic, offering internal hearing aids financing to patients can be a highly risky practice.

Here's why:

- Payment defaults: One of the most glaring risks associated with offering hearing aids financing is that patients may not be able to commit to the payment, thus leading them to default on their loan. On one hand, this can lead to credit damage for your patients, something which can result in them filing for bankruptcy. What's more, it also implies either a delay in the patient's payment for your services or an outright inability to do so.

- Elevated default percentages: Internally finance programs tend to have a higher rate of default patients than those which are managed by third-party lenders. This is because external institutions usually have stricter eligibility requirements that reduce the chances that potentially problematic clients slip through and end up leveraging a clinic's services.

- Credit score issues: On one hand, internal hearing aids financing can only be applied to those patients who can demonstrate a credit history. Therefore, it excludes those patients who cannot display their credit information. On the other hand, it does not provide a solution to those patients who may be in a good financial place yet their credit score does not reflect so because of a negative history they had with borrowing.

- Payment discrepancies: Offering internal hearing aids financing means that your company is responsible for handling any payment discrepancies on behalf of its customers, which could lead to legal issues if you're unable to recoup losses incurred through these types of arrangements.

Having examined these elements, let us now turn our attention to the second option that clinics have at their disposal for financing; external finance programs.

External Financing Programs

External finance programs are the preferred option by clinics as they provide the most streamlined and effective method to offer hearing aids financing.

This is because external hearing aid financing programs are typically third-party lending providers that have established relationships with a range of clinics in order to facilitate their services.

As such, clinic owners do not need to worry about any legal disputes or administrative nuances when using these types of financing channels.

Ideally, one of the most common types of external finance programs is flexible finance plans.

A flexible finance plan is a hearing aids financing option that is tailored to the needs of a particular hearing clinic.

By their nature, flexible finance plans grant clinics the ability to set their own repayment terms and conditions for hearing aid purchases that suit their individual business model and patient profile.

This means you can offer hearing aids financing options such as installment payments or leasing contracts on your terms while still providing patients with access to hearing healthcare services at an affordable price point.

There are several types of lenders that offer these services. However, clinics typically benefit more from those who have a strong-rooted value system that emphasizes customer-first solutions. That way, they are more likely to understand your needs as a small business in the hearing aids field and design solutions that work.

Benefits of Flexible Finance Plans

Some of the main benefits associated with flexible finance plans for entities that offer hearing aids as a service include:

- Higher hearing aid sale conversion rates: Clinics that offer flexible finance plans experience greater chances for an increase in the sales of hearing aids. This is because the flexible nature of the finance plan makes the service more accessible to customers.

- Improved customer loyalty and retention: Customers are more likely to stay loyal and continue their hearing aid service with the company if they have access to a flexible finance plan. This has a positive impact on your overall business and growth strategy since client retention is usually always cheaper than client acquisition. Therefore, flexible finance plans help you in the long term to double down on solid and sustainable growth goals.

- An increased market share: Providing customer hearing aid financing increases your market share be it on a local or regional scale. This is because you are delivering solutions that allow you to stand out among your competitors in a positive way.

- A better customer experience: Offering flexible hearing aid finance plans will give people a more enjoyable purchasing experience and provide them with a sense of relief knowing that they can afford your product or service even if it may be too costly for them to pay in one go.

How To Choose a Hearing Aids Third-Party Lender

Flexible finance plans form one of the pillars of a solid hearing aids finance strategy.

For that reason, careful attention must be paid to the type of lender you partner with.

it's important to align with a third-party flexible finance lender who has the right values and morals that will deliver the kind of legitimate, professional customer-centric solutions you need to increase the margin of success of your finance solutions.

Here's how you can team up with Time Investment Company to do just that.

Flexible Finance Plans with Time Investment Company

Time Investment Company is a finance company that has spent the last forty (40+) years assisting businesses to secure the financial solutions they need to succeed.

For years, we have collaborated with entities within the medical, cosmetic, dental, and healthcare sectors respectively to help them craft and implement winning flexible finance plans that attract customers and bring higher service orders. With TIC, hearing aid service providers such as yourself now have the ability to offer flexible and affordable payment options that still promise you a respectable profit margin on each patient.

Our process is straightforward. Once a patient has confirmed their order, we release the full payment amount to you so you can secure the capital you need as soon as humanly possible.

We at TIC at committed to delivering financial solutions that work.

Set up a strategy call with one of our team members who will walk you through the application process.

Start Offering Hearing Aid Financing

Hearing aids financing has the potential to be a lucrative practice for those clinics that align with the right third-party finance companies.

Time Investment can help you.

Book a strategy appointment with us so you can start delivering the kinds of solutions your customers are looking for.

Best Home Improvement Marketing Tactics to Grow Faster

Posted on March 25, 2022

Your home improvement company can have the best closers in the world. But you still have to get your salespeople in front of qualified people to sell to. That means you need to generate or buy qualified leads. And that, in turn, means investing in digital marketing and other marketing strategies.

Here are some of the most important home improvement marketing strategies, digital marketing strategies, and lead generation techniques in use today among home improvement contractors and remodeling services businesses.

1. Begin with the end in mind.

Take a step back and think about your home improvement business model as a whole. Exactly what products or services do you want to sell, and what kinds of people buy them? Only once you answer those questions can you create an efficient, focused marketing system that will reliably place your home improvement company message in front of the right people.

2. Define Your Key Marketing Techniques and Metrics.

These are a little different for any home improvement business. Every market is different. But there are two vital metrics you should be looking at because they drive your marketing strategy and decision-making process:

Measure Your New Customer Acquisition Cost (CAC).

This figure represents your marketing and onboarding expenditure for each of your new customers. Your CAC is the number of marketing dollars you need to spend, on average, to bring a new home improvement customer on board. It's an accounting of your all-in cost to promote your brand, generate quality leads, and nurture leads through the sales process.

This marketing budget figure may include, but is not limited to:

- Advertising costs and ad charges per click,

- Web content

- Direct mail

- Sales recruitment and training

- Commissions and incentives paid

- Total costs paid for qualified leads

- Digital marketing consultation and digital marketing agency fees

- Cost of time spent monitoring online reviews and responding to customers on review sites

- Search engine optimization and online marketing costs

Your goal is to lower this number and keep it low, by keeping your marketing spend very efficient. But don't be afraid to spend what it takes to rank well in the search engines.

Measure Your Customer Lifetime Value.

This is the net present value of the total future stream of income you can expect of a new customer.

Lots of people don’t stop at one home improvement repair or upgrade. They’ll do multiple projects over a period of years. They may move across town and need work done on their new home. Or they may have kids move away and want to turn a bedroom into a home office.

Either way, a certain number of your existing customers will come back to you for other work.

Create a digital marketing strategy to keep your name and brand in front of your customers.

3. Focus on Customer Retention.

It’s usually a lot cheaper and more profitable to get repeat business than it is to generate a new customer from scratch. Your existing customers already know you and your work. They know your brand. They already know you can deliver. It’s just a matter of leveraging digital marketing tools and techniques and reaching them at the right time, maintaining a “top-of-mind“ presence… and making sure your customers are very happy with the value of your offering.

That doesn’t mean you don’t market to them. That just means your digital marketing to this segment will be much more efficient than your marketing to the general public. Upselling and cross-selling to your existing customers maximize your CLV number and is a great way to invest your marketing dollars.

4. Provide Potential Customers with Flexible Finance Plans.

Many customers won’t have the cash on hand for your services up-front. In fact, studies show that most Americans would have trouble meeting a $1,000 expense without having to borrow money.

While homeowners tend to be more affluent than renters, that doesn’t mean they have enough cash on hand to handle emergency home expenses or start the improvement projects they’d like to do.

According to a recent Consumer Affairs report:

- 69% of homeowners feel “house poor.”

- 3 in 5 homeowners didn’t expect repair, maintenance, and upkeep costs to be as high as they are.

- 3 in 5 homeowners are sacrificing home-related essentials in order to afford their housing costs.

This is where flexible finance plans come in: Flexible financing allows customers to pay for projects or services in convenient and affordable installments. We help home improvement companies help their customers do just that.

A good financing program with a finance company that understands your business and your customers is absolutely a differentiator from your competition – and you should advertise it as such. Don’t limit your market to people who happen to have oodles of cash on hand. Offering a flexible financing plan enables you to serve exponentially more people, and generate more business and growth.

The best finance companies for a home improvement business should offer the following:

- Easy, quick applications

- Fast credit decisions

- Common-sense, manual underwriting of ‘on the edge’ applications

- Approves a wide range of credit types - not just people with perfect credit

- Lends enough to cover a large sale

- Flexible terms to keep payments down

- Competitively priced.

The beauty of offering financing is that it's both low-cost and easy to implement, as long as you have the right support.

To offer financing to your customers with a best-in-class consumer finance company that specializes in the home improvement industry, fill out this brief vendor information form.

5. Create a Powerful Home Improvement Internet Marketing and Email Campaign.

Email marketing is a solid and results-proven way to grow your home improvement business.

Great email marketing strategies are based on three key components:

- A captivating subject line that compels people to open your email and read it.

- High-quality content, such as blog posts or videos, for viewers so that they stay engaged with your message.

- Relevant clickable links throughout the email for readers to take immediate action and convert into customers.

As a home improvement business launching an email marketing campaign, strong calls to action at the end of each email rather than simply providing information about home improvement services or products will be effective in engaging your potential home improvement clientele.

For example, ask recipients if they want to see more examples of completed past home improvements projects in your portfolio or how their experience was when using a particular product. This way you will see which types of messages resonate better than others so you know what kinds of details to focus on.

Develop an advertising strategy that makes sense, targeting specific keywords such as "home improvement contractor."

Make sure you have a responsive website that displays well on both desktop/laptop computers and mobile devices.

A good digital marketing plan will create sales 'funnels' designed to convert visitors into sales leads, capture detailed information on those leads, and then nurture leads through the entire sales process until they become new home improvement customers.

6. Create a Powerful Incentive for Referrals.

The easiest way for a home improvement contractor to incentivize customer loyalty and drive sales is through referral programs. For instance, if someone invites their friends or family members on Facebook to use your services, you can offer them an exclusive discount in exchange for it.

Social media sites like Twitter also enable people to share information about your company with others who may be interested enough in your services, thus making these different social network avenues worth exploring.

7. Leverage Social Media and Online Groups.

Nowadays, businesses are realizing that they can tap into their target audience via online social groups. If you're in the home improvement industry, then this is a great way to find potential customers. Be active, friendly, and helpful in relevant online discussion forums and bulletin boards.

The best social media practice builders know how to sell by not selling. That is, they position themselves as approachable, reliable, and knowledgeable subject matter experts. They don’t pitch their own products or services, other than letting people know who they are. They concentrate on serving their customers and the general public.

And they get more than their share of business by doing just that.

8. Maximize Home Improvement Company Local Search Results.

Unless you’re a truly national business that can work anywhere, you want to focus on generating search results specific to your city, county, or state.

Here’s why:

- 46% of all searches on Google have local intent.

- 97% of users searched online to find a local business.

- 28% of all local searches are followed by a purchase.

- 24.4% of clicks on local searches will go to the first business listed.

- “Near me” searches grew by 136% last year.

To maximize your benefit from local search traffic, make sure you have content on your website or blog specific to your location. It could be case studies from local projects, reviews of other local businesses or contractors, blog posts that mention your town or the places you want to do business.

Ready to Take Action?

The time to take advantage of the home improvement industry is now.

A compelling marketing strategy that lays out the roadmap for the tactics you need to implement will serve you well.

Without a doubt, flexible finance plans are one of the most powerful ways to grow your business.

National Association of the Remodeling Industry (NARI) Review: Is It Worth It to Join?

Posted on March 23, 2022

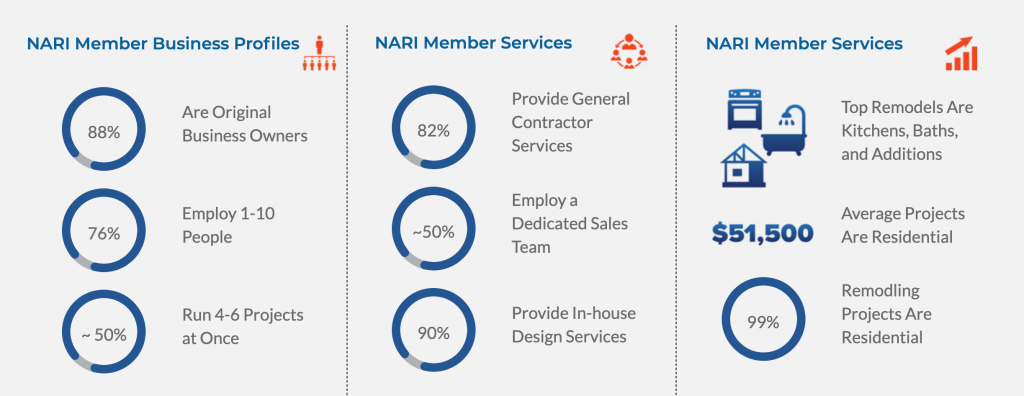

The National Association of the Remodeling Industry (NARI) is an independent trade association whose primary purpose is to boost the professionalism of the home improvement industry and foster better relationships between service providers and their clients. In addition to upholding the remodeling industry's professionalism, the association runs ongoing certification programs and publishes educational consumer publications.

The NARI's thousands of professional remodeling industry members pledge to commit to maintaining high standards of professionalism, sound business practices, vital public purpose, honesty, and integrity.

The NARI community comprises business professionals such as product manufacturers, consumer publication leaders, lending and utility institutions, distributors, suppliers, and professional remodeling contractors, among others.

In addition, the NARI also frequently serves as a matchmaker, connecting consumers (homeowners, residential landlords, and commercial landlords) with remodeling contractors and professionals with the skills to meet their needs.

Credits: NARI

Types of NARI Memberships

NARI membership comes in two types: You can join a local NARI chapter, or you can be a NARI member-at-large.

The at-large membership includes participation in the following association and industry events.

- NARI Fall Leadership Summit

- NARI Spring Business Meeting

- Educational and training events

- Trade shows, conferences, and vendor expos

- Contractor of the Year Awards

- Consumer-focused events

- Community service and social events

- Workforce development and recruitment events

- Committee and Leadership events

Chapter membership includes participation in the following activities at the local or chapter level:

- Chapter meetings and events

- Education and training events

- Conference, trade show, and vendor expos

- Consumer-focused events

- Community service and social events

- Workforce development and recruitment events

- Committee and leadership events

Advantages of Joining the National Association of the Remodeling Industry

Contracting is a people business. A lot of your success and future business growth depends on you getting to know people - and people in the industry getting to know you. When they know you and trust your competence and work ethic, you’ll be considered as a subcontractor on more jobs. And you’ll have an easier time bringing the best subcontractors to work on projects under you.

NARI is the primary professional association that specifically focuses on the building remodeling industry within the United States. It boasts thousands of member firms, including some of the biggest, most prominent general contractors in the industry. These firms routinely bring business to subcontractors, and the NARI staff and leadership may refer bid opportunities directly to you, if you meet a contractor’s or landlord’s needs and skill set.

As such, NARI is a huge resource for contractors looking to expand their business networks and their exposure within the industry.

Benefits for Consumers

As an industry body, NARI also does a lot of things that benefit consumers as well as their construction industry members. Here are some ways that NAR benefits consumers and the general public at large.

Reduced Risk of Construction Defect Problems

The NARI consumer-members tend to be large landlords that own a lot of commercial or multi-family real estate or are serious real estate investors, and who frequently have large remodeling projects themselves. They leverage NARI expertise to get higher quality work done, reduce their risk exposure, and generally make life easier.

The quality control piece is important: According to a PlanGrid study, $31 billion of construction work done last year was due to a need to correct or redo shoddy or substandard remodeling and construction work. These consumers of remodeling services know that if they work through NARI, they are much less likely to have construction defect problems.

Referrals to Specialist or Artisan Contractors and Tradesmen

NARI frequently refers customers to contractors or tradesmen with advanced, specialized, or artisanal level skills. These experts can be hard for outsiders to find. The NARI helps consumers find contractors with the rare skill sets they need,l and brings new bid opportunities to the contractor as well.

Benefits for Contractors

Membership in NARI brings a number of important benefits to construction industry companies, including contractors, vendors, suppliers, consultants, and others.

Access to NARI Member Projects

Consumers of remodeling services who join NARI tend to be serious customers who do a lot of remodeling projects. That’s why they joined the association, to begin with. When they solicit bids on remodeling jobs, they tend to prefer other NARI members - as will the general contractors when they look for subs.

Solidify Your Reputation

Assuming that you stick to the quality expected of NARI professionals, customers will spread the word on the good work that you did for them and, in turn, help maintain your good reputation with other association members.

Engage in More Successful Partnerships

According to a study done by PlanGrid in partnership with the FMI corporation, an estimated $177B annually is lost in the construction industry due to poor communication not only among team members but also between professionals and their clients.

NARI customers are serious about communicating their needs. As a result, you can be sure that they will be clear in their communication so as to ensure a healthy, hassle-free working relationship for both parties.

Connect With Key Allied Vendors and Services

NARI members aren’t limited to contractors and landlords. NARI also connects contractors and members with other vendors and service providers who focus on supporting the remodeling industry.

For example, NARI often helps contractors connect with consumer finance companies like us, which helps contractors grow their business by making it possible for customers to finance their purchases over time, in a series of affordable payments. If you want to offer your customers additional financing options to help make your services more affordable, we can help with that.

NARI also helps connect contractors with vendors who sell construction tools and equipment, materials and supplies, provide equipment financing, insurance, advertising and marketing services, PR, legal services, and other goods and services specific to the home remodeling industry.

6 Best CRM for Contractors & Home Improvement

Posted on March 20, 2022

Research shows that a staggering 38% of businesses underestimate the importance of a proper customer relationship strategy. The same study shows that 65% of customers have switched to a different service because of poor customer service.

Another study shows that just 29% of companies engage with existing customers beyond the initial purchase.

That’s a massive missed opportunity - and a huge competitive advantage for contractors who are organized and systematic about keeping their names in front of their happy customers.

Whether you're running a big or small business, the right customer relationship management (CRM) system can help improve your sales and customer retention management process. Where a great financing program can help make it easy for customers to say “yes,” CRM programs help with better data management, marketing automation, sales pipeline management, and general client relationship capabilities.

But not all commercially available CRM platforms are alike. They vary widely in pricing, features, ease-of-use, compatibility with other systems, and scalability.

Here are the 6 best CRM for contractors on the market today that can help any home improvement contractor improve sales, improve customer retention, and keep your business growing.

HubSpot CRM

Price: $50 per user per month with premium

Free Trial: Yes

Although HubSpot CRM isn’t designed specifically for home improvement contractors, its clean design and polished features make it one of the best CRM solutions for contractors in any industry. Its outstanding free version comes loaded with features, and makes a great entry-level solution for small contractors just getting started.

Some contractors might even find that HubSpot CRM free trial can work better than other CRM paid versions.

HubSpot CRM helps your sales team log activity, capture leads, and manage the sales pipeline. Blogging, SEO, and email marketing tools are all available with the paid upgrade.

This makes HubSpot CRM a great system to test out before going deep and investing money in a paid program.

HubSpot CRM software is very scalable and gives you the ability to easily migrate to another CRM solution if HubSpot CRM doesn't end up to your liking.

Top CRM Features:

- Fantastic free plan. HubSpot offers the best free plan in the business. For startups and businesses that are just progressing beyond manual processes, integrating an excellent CRM costs nothing. Your sales teams can get started improving your sales pipeline management right away.

- Intuitive & user-friendly. Even home improvement and construction professionals who are not computer whizzes will find HubSpot CRM software easy to use and understand. This is primarily thanks to the HubSpot drag-and-drop system.

- Scalability potential. HubSpot features modules for marketing, sales, customer service, and operations in addition to its own CMS. HubSpot also offers a market-in-one approach to cover lead management features under one roof.

Builder Prime Construction CRM Software

Price: Starts at $79 per month

Free Trial: Yes

Where HubSpot is a general solution that’s not industry-specific, Builder Prime was built specifically for construction and home improvement contracting business from the ground up. This cloud-based construction CRM makes project management and customer relations easy and it has key features specifically tailored for home improvement and construction project management businesses.

Builder Prime's construction management software solution can massively reduce your workload compared to manual processes and legacy systems. By reducing your workload, the CRM provides you and your team the time to focus on more productive tasks: Actually calling leads, setting appointments, closing sales, and serving customers.

Overall, Builder Prime is a great solution for both a big and small business looking to create new leads and maintain the old ones without getting overwhelmed.

Builder Prime also features excellent support for mobile devices, so your team can easily use the program on the go.

Builder Prime’s monthly price point is higher than HubSpot’s. But for construction and home improvement contractors, the additional construction-specific functionality is more than worth the investment.

Top CRM Features:

- Effective automation. Builder Prime does a great job at automating most of the workload. So your team can focus on working with customers, not fighting your software.

- Contact management & billing. Builder Prime makes it easy for a business to stay in touch with customers and send professional-looking invoices in a snap.

- Insightful reports & data entry. Collect data that helps you make better decisions on future construction projects.

JobNimbus CRM & Project Management

Price: Starts at $25 per user, per month

Free Trial: Yes

JobNimbus is a cloud-based software and project management tool that helps contractors with customer relationships, sales pipeline management, job costing, and invoicing. It contains great project management tools, and includes top-of-the-line sales management tools for construction companies.

But what makes this JobNimbus great is that specialty contractors can easily customize the platform to fit their specific needs. JobNimbus makes it a snap for users to customize most business processes without needing a masters degree in computer science.

The handy templates make it easy to create contracts and even presentations that fit your individual business needs.

The software also offers some excellent integration features, including calendar and email notification tools to help users manage construction projects and personal life matters in one convenient interface.

Top CRM Features:

- Easy contact management system. A great overview of your existing contacts with useful filtering tools.

- Compatible with other platforms. Integrates seamlessly with leading third-party software such as QuickBooks, Google Calendar, Zapier, etc.

- Budget Tracking/Job Costing. Integrates accounting features to help contractors with time tracking, document management, and invoicing.

MarketSharp

Price: Starts at $99 per month

Free Trial: Yes, in the form of a demo

MarketSharp CRM is a potent tool that can help any construction company manage customers, sales pipeline, and job costing. The software also offers tools like invoicing automation and an intuitive dashboard. Hence, managing multiple businesses becomes much easier, which frees up more time for focusing on business development.

Additionally, MarketSharp construction CRM software integrates readily with a wide range of third-party solutions for effective customer feedback collection and data analysis. Not only will you have a transparent overview of your sales pipeline and customer service statuses, but you'll also get a better idea of how to offer client financing solutions.

Finally, MarketSharp’s CRM customer support team is very responsive. They have a great reputation where it counts - among their own customers. If you have a problem, you can expect a response that goes beyond general replies and provides constructive feedback.

That’s unusual these days - and that’s valuable because any CRM downtime can cost your business a lot of money.

Top CRM Features:

- Specialized CRM construction features. MarketSharp has all the necessary features and sales tools for a home improvement or construction management business.

- Great reputation management. Helps create and maintain a solid reputation in the construction industry, leading to profitable referrals.

- Compact database. It's easy to keep data transparent and track profits per month or per user case.

ImproveIt 360

Price: Starts at $150.00 per feature, per month

Free Trial: Yes, in the form of a demo

Improveit 360's construction software focuses on improving data tracking to make better business decisions. Improveit’s CRM has capabilities for scheduling, quoting, project management, and reporting.

Improveit 360 is an excellent choice for growing or established remodelers and larger construction businesses.

It works for remodeling and construction projects because you can also manage teams and streamline communication besides managing customers.

Also, despite being loaded with valuable features for construction and home improvement industry users, Improveit 360 manages to do a great job of simplifying the process for each client.

Users can create personalized dashboards for their sales and marketing teams. And its intuitive collaboration features make it easy to keep everybody in the loop of what's going on with each client.

Top CRM Features:

- Auto activity tracking. You want to know where your leads are in the sales funnel. You can get all of their information electronically and automatically log what they have done. That's easy with ImproveIt 360's lead management tools. This way, it will be easier for you to manage them and make the sale happen more quickly.

- Work scheduling. Tell your team when they need to be at an appointment with a customer. Create notifications and integrate them in your calendar, so your team doesn’t miss a beat.

- Project management. Track your progress with a total overview of all active projects. Track the cost of each project and see how much money you are making from them.

Unanet CRM by Cosential

Price: Full User – $70 per user, per month. Read-Only User – $10 per user, per month

Free Trial: Yes, in the form of a demo

Unanet construction software is another leading CRM tool designed specifically for construction and home improvement contractors. It features tools like lead and project management, email support, and professional-looking, auto-generated proposals. Unanet also has tools for subcontractor management and more. Unanet is a particularly compelling solution if you routinely work with other businesses in the construction, architecture, or engineering fields.

Data collection is efficient, accurate, and fast. Remodeling and construction management can plan budgets and deliver projects in a timely fashion while providing exceptional customer service.

Although a uniform solution, users can customize the interface based on the type of work. Your developer can c so you get the data you need, while your sales and marketing team can stay on top of customers' data without interfering with other departments.

The software integrates well with MS Outlook and most other industry-specific applications that home improvement contractors commonly use.

Top CRM Features:

- Efficient update solution. It's easy for users to keep team members up to date across the board on everything going on with a specific customer.

- Activity management. Unanet makes it easy to track and report progress, so you can keep up to date on everything going on within the firm without having to get your foremen and supervisors on the phone all the time.

- Proposal management. Unanet’s easy-to-use proposal generation function can save hours, allowing your team more time to respond to bid invitations, generate more proposals, focus on customer service, and develop more relationships so you can grow your business.

Close Bigger Sales By Offering Financing

Contractors know that it’s tough and expensive enough to acquire a lead and nurse it all the way to the presentation stage. You don’t want to lose a good customer at that stage because they don’t happen to have the cash on hand to pay for the entire project upfront.

Sure, they could potentially get a personal or home equity loan to cover the cost. But that process can take days or weeks - and it takes the process out of your control. Banks notoriously deny loans to people with fair or poor credit. And you could lose the customer in the time it takes for them to get approved.